I don’t want to lock my money into super

Two alternative strategies that many investors consider are:

• borrowing to invest (i.e. entering into a gearing strategy), outside super; and

• increasing pre-tax contributions to super and investing in the superannuation environment.

Which is best? The comparison is not straightforward, but is often hijacked by raising the issue that your money is “locked away” in super. For those some years away from being able to access their super, this is often a compelling point in favour of gearing.

But to give gearing strategies the best chance to succeed, the investor needs a long investment horizon – at least 10 years. They need to mentally lock their money away.

Having the flexibility to access your capital often makes it harder to maintain the long term discipline so essential to being a good investor. We think accessibility is an over rated issue.

How do I choose between a gearing and super strategy?

We have used an example to help identify what we think are the main issues to consider. John and Jenny, both aged 39, have identified their expected surplus cash flows over the next 25 years. They feel they can each comfortably forego gross salary of $10,000 a year and are considering two options:

- a “super strategy”, where they increase their pre-tax contributions to super by $10,000 p.a. each ; and

- a “gearing strategy”, where they borrow $285,714 to invest in a jointly owned portfolio. The interest payments on the loan are assumed to be tax deductible and amount to $20,000 p.a. (i.e. an interest rate of 7.0% p.a.)

In both cases, funds are invested in a high growth portfolio with identical risk and return characteristics.

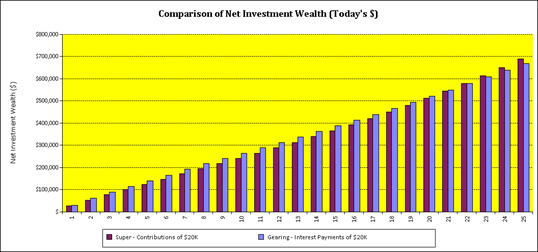

The chart below shows the movement in investment wealth over the following 25 years for each strategy:

The gearing strategy slightly outperforms in the earlier years. However, the tax advantages of investing in the super environment results in the super strategy being marginally better over the entire period.

You could conclude from this simple comparison that gearing is better suited to shorter time frames and super to longer time frames. However, this conclusion ignores the fact that the gearing strategy is riskier.

Borrowing brings forward future savings (via the use of a loan) and invests the lump sum today, compared with regular, smaller instalments to super and investment over time. It is riskier because more capital is exposed to market related risk for longer. Given the higher risk, to choose the gearing strategy you should expect it to do much better than the super strategy.

In fact, based on the assumptions used in our example, on a pre-tax basis the gearing strategy outperforms the (ungeared) super strategy by more than 66% over the 25 year period, reflecting the additional risk. Yet, after-tax, the super strategy out performs the gearing strategy by 5%, implying its tax advantages are considerable.

It is ironic that many investors are persuaded to choose gearing over super because of the former’s purported tax effectiveness.

Ignoring risk means you are comparing apples with oranges

Typically, as in the above analysis, most investment strategy comparisons ignore risk. While this helps to simplify decision making, it invariably reduces the quality of those decisions.

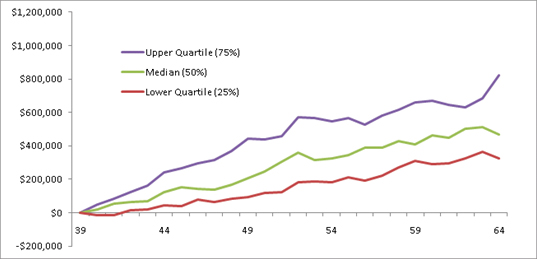

To compare the risk of the gearing and super strategies, we assumed some variation in the annual returns of the investment portfolios. Rather than annual returns remaining the same each year, we assumed that they would vary across a range of outcomes determined by the portfolios’ volatility, which we assumed as 15% p.a.

We then generated 1,000 series of possible 25 year investment returns, that were used to calculate 1,000 potential results for each of the gearing and super strategies. These results were sorted into quartiles for each strategy, as shown in the charts below:

Super Strategy

Gearing Strategy

It is clear that, particularly in the earlier years, there is considerably more variability associated with the gearing strategy than the super strategy.

Also, as the table below reveals, for each quartile, at the end of the 25 years the super strategy outperforms the gearing strategy. The compounding tax benefits of super are clear.

| Position after 25 years | Lower Quartile | Median | Upper Quartile |

| Super Strategy | $574,173 | $698,619 | $1,001,546 |

| Gearing Strategy | $323,548 | $466,793 | $820,362 |

When investment risk is taken into account, it really makes you wonder why so many investors favour gearing over a salary sacrifice strategy.

Is superannuation just too boring?

Superannuation continues to offer a sound, tax effective strategy that all investors, including those some way from expected retirement, should not ignore. It may not provide the same level of excitement as holding a geared exposure, but investing should not be confused with entertainment.

Many younger investors opt for a gearing strategy because it provides a more immediate opportunity to see some significant results. Unfortunately, they may be adverse. If you’re a smart investor and prepared to be patient, the rewards of committing to a long term super strategy are likely to leave you in much better shape.

1 Comment. Leave new

[…] that highlights this is the use of superannuation. We’ve talked previously about the significant benefits of making pre-tax contributions to super. However, in this article we look at the benefits of making post-tax contributions to super. The […]